Not crypto. Just digital. So, centralized, subject to anti-fraud regulation, reversible transactions, etc.

Not loaned out. Explicitly marked as not-loanable. Which would be foolish in today’s market, because you’re losing out on a dividend. Except… the bank actually keeps most of the benefit from your deposit being loanable normally. This way, you get the benefit instead.

Basically, it allows depositors to compete against the banks. So they can’t take you for granted, because you actually have alternative.

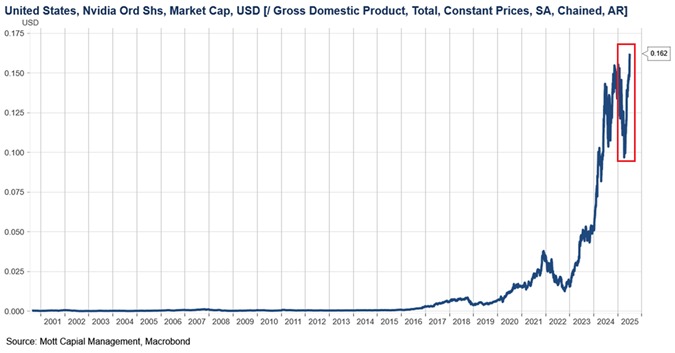

$10-20mil in the year 2571 is like $0.15 today